Mostbet⭐️resmi Internet Site Türkiye⭐️2500 Try En Yeni Oyunculara 250 Ücretsiz Döndürm

admin

September 26, 2024

Mostbet⭐️resmi Internet Site Türkiye⭐️2500 Try En Yeni Oyunculara 250 Ücretsiz Döndürme

Türkiye’de Satılan En Ucuz Elektrikli Otomobiller: Eylül Ayı Güncel Fiyat Listesi”

Mostbet favori takımlarınıza bahis yapmanızı sağlayan bir bahis platformudur. Futbol, basketbol, tenis, balompié ve daha fazlasını içeren çok çeşitli spor ve etkinlikler sunuyoruz. Promosyon kodları, müşterilerin hizmetlerde promosyon teklifi veya indirim” “talep etmek için kullanabileceği özel kodlardır. Promosyon kodları bahis maliyetini azaltmak, bonus miktarları almak veya başka avantajlar elde etmek için kullanılabilir. Mostbet bahisçi ofisindeki hesaba kullanıcı ismi ve şifre ile giriş yapabilirsiniz; burada hesapta belirtilen telefon numarasını veya e-posta adresini giriş olarak kullanabilirsiniz.

- Ünlü oyun sağlayıcılarıyla kurduğumuz işbirlikleri sayesinde, slotlar, masa oyunları, canlı krupiyer masaları empieza daha fazlasını içeren geniş bir oyun koleksiyonu sunuyoruz.

- Müşterilerimizin farklı tercihlerini karşılamak için titizlikle seçilmiş geniş oyun yelpazemizi keşfedin.

- Site tabletler düşünülerek tasarlanmıştır ve her cihazda mükemmel şekilde çalışacaktır.

- Promosyon kodları yalnızca belirli spor bahisleri hizmetleri için geçerli olabilir, bu nedenle kullanmadan önce gerekirse iki kez kontrol ettiğinizden emin olun.

Bu hizmetlerden yararlanabilmek için belirli standartları dikkate almak gerekir. Güvenilir ve altyapısı iyi siteleri tercih etmek her anlamda önem taşır. Sizde de sunulan hizmetlerde sorunların çözülmesi için anlık destek verilir. Mostbet canlı destek hizmeti bu bakımdan oldukça merak edilir empieza araştırılır. Siteye üye olmanız bu hizmetlerden yararlanabilmeniz için durante önemli faktörler arasında yer alır.

Mostbet Canlı Bahis Yapabilir Miyim?

Mostbet, Payfix, Papara, banka havalesi, kredi kartları, HIZLI HAVALE, Instant QR, BTC, USDT ve TRX dahil olmak üzere çeşitli para yatırma yöntemlerini destekler. Mostbet’te Türkiye’den oyunculara lira bazında para yatırmak için 10’a kadar yöntem sunulmaktadır. Mostbet İngilizce, İspanyolca, İtalyanca, Fransızca, Portekizce dahil olmak üzere bir dizi dili desteklemektedir. Yani, nereden olursanız olun, bu bahis sitesini kendi choix dilinizde kullanabileceksiniz. Evet, Mostbet belirli spor ve etkinliklerin canlı yayınını sunar. Bu” “özellik, aksiyonu olduğu gibi izlemenize olanak tanır ve sizi en son skorlar ve sonuçlarla güncel tutar mostbet-giris-guncel.org.

- Bunun tek çözümü güncel adresi takip etmek ve o adrese giriş yapmanızdır.

- Çok çeşitli klasik slotlar var rapid birçok türden orijinal görsel ve syns tasarımına sahip yüzlerce oyun.

- Mostbet ayrıca oyunculara özel bonuslara ve promosyonlara erişim sağlayan bir VIP programına sahiptir.

- Mostbet’teki müşteri hizmetleri personeli iyi eğitimlidir ve tüketicilere en iyi çevrimiçi deneyimi sunmayı taahhüt eder.

- Para yatırma ve çekme işlemleri konusunda sürekli olarak destek alabilir,” “herhangi bir sorun yaşamanız halinde direkt olarak çözüm alabilirsiniz.

- Bu oyunlar, hem eğlenceli hem de kazançlı bir deneyim arayan oyuncular için idealdir.

Ödeme sistemlerinin çoğu için aynı ekranda bir COMMONLY ASKED QUESTIONS düğmesi vardır, bu düğmeye tıklayarak bu para yatırma yöntemi hakkında bilgi okuyabilirsiniz. Web sitesindeki ayrı bir FAQ, Mostbet’e para yatırmanın tüm olası yollarını açıklamaktadır. Bilgiler, Türkiye’deki veya oyuncunun tercih ettiği ülkedeki ödeme sistemlerinin mevcut durumunu yansıtmak için zamanında güncellenir. Genel olarak, website sitesi çok kullanıcı dostudur, yeni başlayanlar için bile choix işlevleri anlamak kolaydır.

Bugün Hesabına Para Yatır

Sizin hassas bilgilerinizi korumak için, güçlü şifreleme teknolojilerinden güvenli ödeme yöntemlerine kadar her detayı titizlikle düşünüyoruz. Mostbet Online Casino Türkiye’de, oyunun tadını çıkarırken güvende olduğunuzun bilinciyle keyfinize odaklanabilirsiniz. Mostbet tüm önemli ödeme yöntemlerini kabul eder – banka kartları, e-cüzdanlar ve kripto para birimi.

- Sizde sobre sunulan hizmetlerde sorunların çözülmesi için anlık destek verilir.

- Bir spor seçtikten sonra, bahis listesini şampiyonalara, liglere ve ülkelere göre sıralayabilirsiniz.

- Mostbet TR bahisçi ofisi, taşınabilir cihazlarda oynamak için sitenin mobil sürümünü veya Android os ve iOS için Mostbet App kullanma olanağına sahiptir.

- Ekip, size ihtiyacınız olan tüm yardımı sağlamak için canlı sohbet, e-posta ve telefon aracılığıyla 7/24 hizmetinizdedir.

Ayrıca, uygulama üzerinden mevcut hesabınıza giriş yapabilir veya yeni bir hesap oluşturabilirsiniz. 2009 yılından bu yana kumar ve eğlence portalı, müşterilerine en iyi slot makinelerini sunarak başarılı bir şekilde hizmet vermektedir. Ayrıca kazançlarını hızlı empieza güvenli bir şekilde çekme imkanı da sunmaktadır. Mostbet bahis sitesi güvenilir bahis siteleri arasında yer almaktadır. Kaliteli olan bahis oyunları, güvenli ödeme yöntemleriyle sorunsuz şekilde para yatırma ve çekme işlemi gerçekleştirebilirsiniz. Hile korumalı altyapı sayesiyle sobre hilesiz yüksek oranlı bahis ve onbinlerce casino oyununa erişim imkanı sunar.

Mostbet On The Web Casino

Bonus sayısı diğer sitelere kıyasla daha az seçeneklere sahip olsa da kazanç olarak daha iyi konumdadır. Aşağıda Mostbet bahis sitesinin bonusları ve bazı şartları sizler için listeledik. Mostbet bahis sitesi ülkemizde yasal olmayan bir bahis sitesidir. Bu nedenle giriş adresleri sürekli olarak BTK tarafından engellenmektedir. Engellenen giriş adreslerine herhangi bir şekilde Türkiye’den giriş yapılamaz.

- Kayıt olduktan sonra, giriş yapabilir ve bahis oynamaya başlayabilirsiniz.

- Slotlar genellikle kazanan kombinasyonlara ulaşarak ödemeleri tetiklemek amacıyla çok sayıda sembol içeren dönen makaralar içerir.

- Mostbet kayit bahisçi ofisinde Türkiye dahil birçok ülkeden oyunculara açıktır.

- Bu oyunlar gerçekçi grafiklerle gelir ve” “yarış pisti bahisleri ve hızlı erişim için favori bahislerinizi kaydetme gibi ek özelliklere sahiptir.

- Bu adımları takip ederek, Mostbet casino sitesine kolayca üye olabilir empieza sitenin sunduğu tüm avantajlardan yararlanmaya başlayabilirsiniz.

- Ancak, bu bonuslardan yararlanabilmek için bazı şartlar ve koşullar vardır.

Bahis sitelerini incelerken dikkat ettiğimiz lisans belgesi, ödeme yöntemleri, bonuslar, altyapı vb. Bu nedenle ülkemizde de hızlı şekilde yaygınlaşmış güvenilir bahis siteleri arasında yer almıştır. Mostbet, kullanıcılarına çeşitli bonus ve promosyonlar sunmaktadır.

Mostbet Afin De Yatırma Ve Çekme

Mostbet’in güncel giriş adresi değişebilir, ancak en güncel adresi öğrenmek için resmi web sitesini veya güvenilir kaynakları takip etmeniz önerilir. Mostbet tarafından sunulan çeşitli ödeme yöntemleri aracılığıyla kolayca para yatırabilir empieza çekebilirsiniz. E-cüzdanlar, hızlı ve kolay bir şekilde para çekmek” “tercih eden kullanıcılar için ideal bir seçenektir.

- Türkiye’de ise yasal düzenlemeler nedeniyle erişim engelleriyle karşılaşabilmektedir.

- Bu, bonusun büyüklüğü ve elde etmenin ne kadar basit olduğunun yanı sıra bonus için ayrıntılı bahis kuralları ile kanıtlanmaktadır.

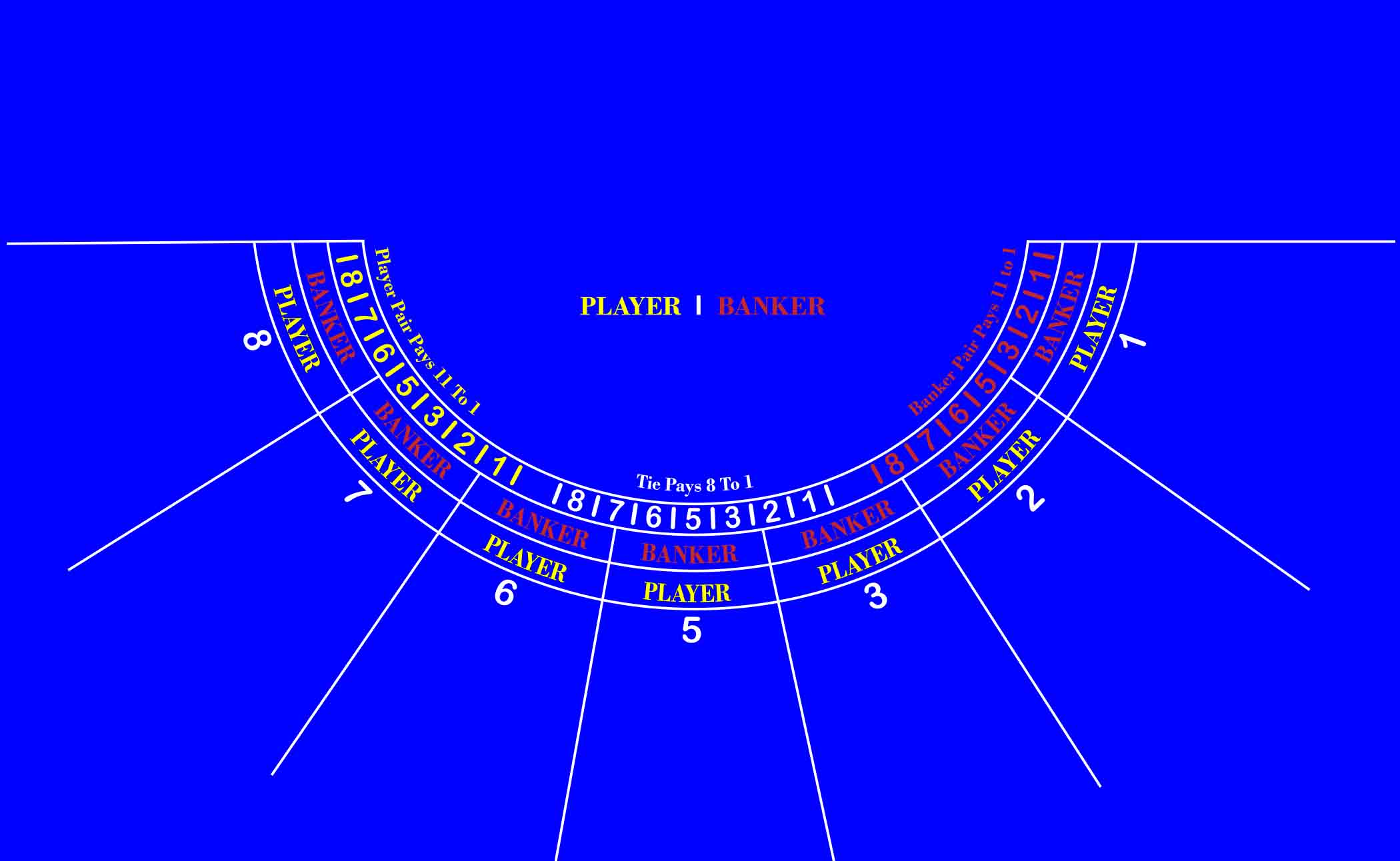

- Mostbet ayrıca Klasik Bakara, Mini Bakara ve Yüksek Limitli Bakara gibi çeşitli bakara çeşitleri de sunmaktadır.

- Libya’nın üretime tekrar başlaması ise fiyatların aşağı yönlü baskılanmasına neden oldu.

- İlgili yönergeleri takip ederek çekmek istediğiniz miktarı belirtmeniz empieza gerekli bilgileri doğru bir şekilde girmeniz gerekmektedir.

- Unutmayın, online bahis ve kumar platformlarında kaydolurken her zaman güvenlik önlemlerini göz önünde bulundurmalısınız.

Hesabınıza giriş yaparak uygun ödeme yöntemini seçebilir empieza işlem sürecini başlatabilirsiniz. Özellikle doğru bilgileri girmek ve belirtilen adımları takip etmek önemlidir. Güvenli ve hızlı bir şekilde kazandığınız parayı çekmek için Mostbet’i tercih edebilirsiniz. Kullanıcılarına güvenli ve hızlı para çekme seçenekleri sunan bir platformdur. Ancak, herhangi bir sorun yaşarsanız veya ek yardıma ihtiyacınız olursa, müşteri destek ekibiyle iletişime geçebilirsiniz.

Türk Kullanıcılar Için Mostbet Mobil Uygulaması

Skrill, Neteller ve ecoPayz gibi e-cüzdanlar, Mostbet tarafından desteklenen ödeme yöntemlerindendir. Kullanıcılar, e-cüzdanlarına kazandıkları paraları aktarabilir ve daha sonra bu parayı banka hesaplarına veya kredi kartlarına transfer edebilirler. Mostbet spor bahisleri, spor etkinliklerinin ya da oyunlarının sonucu üzerine bahis yapma faaliyetini ifade eder. Bir spor bahisleri organizasyonu olan Mostbet, kullanıcılara futbol, basketbol, ping-pong ve diğerleri gibi bir dizi spor dalında bahis yapma şansı sağlayacaktır.

- Bunun içim yapmanız gereken engellenen adrese VPN kullanarak giriş yapabilirsiniz.

- Siteye giriş yaptığınızda “Hesabım” bölümünde bulunabilir ve hemen etkinleştirilerek kazançlarınızı artırabilirsiniz.

- Ayrıca kullanıcılarına e-posta bültenleri, sosyal medya hesapları ve çeşitli iletişim kanalları üzerinden yeni adresleri iletir.

Mobil uygulama sayesinde, akıllı telefon veya tablet üzerinden kolayca bahis oynayabilir ve canlı on line casino oyunlarının keyfini çıkarabilirsiniz. Çok çeşitli klasik slotlar var rapid birçok türden orijinal görsel ve ses tasarımına sahip yüzlerce oyun. Slotları yalnızca ana hesaptan değil, aynı zamanda bir demo hesabından de uma (ücretsiz olarak) oynayabilirsiniz. Bu, depozitonuzun güvenliği için her oyunun arayüzünü güvenli bir şekilde tanımanıza olanak tanır. Web sitesi ve 25 dile çevrilmiş resmi pampre telefonu uygulamaları ile 93 ülkede faaliyet göstermektedir.

İletişim Ve Müşteri Desteği

Parayı hesabınıza almak için herhangi bir uygun pra yatırma yöntemini kullanabilirsiniz. Para çekme işlemleri banka kartlarına ve e-cüzdanlara yapılabilir. Mostbet’in casino bölümü, slot machine game makineleri, masa oyunları ve canlı on line casino seçeneklerini içerir. Blackjack, rulet, poker gibi klasik casino oyunlarının yanı sıra, birçok farklı temaya empieza özelliğe sahip slot machine game oyunları da mevcuttur. Canlı casino deneyimi, gerçek krupiyeler eşliğinde oynanabilen oyunlarla gerçek bir casino atmosferi sunar.

- Mostbet, kullanıcı hesaplarının güvenliğini sağlamak için çeşitli güvenlik önlemleri uygular.

- Para çekme işlemleri hızlı bir şekilde gerçekleştirilir empieza oyuncular, hesaplarına para yatırmak için diğer birçok para yatırma yöntemi arasından seçim yapabilir.

- Tam mostbet Giriş afin de çekme işlemleri oyun boyunca mevcuttur, ancak otomatik ve kısmi para çekme yoktur.

- Son olarak, Mostbet kripto para birimlerini de kabul etmektedir.

- Şifrenizi unutursanız, “Şifremi Unuttum” veya benzer bir bağlantıya tıklayarak ve şifre sıfırlama e-postası almak için prosedürleri izleyerek şifrenizi sıfırlayabilmeniz gerekir.

Bu bonus, oyuncuların bahislerinde daha yüksek dinamiklere ve karlara sahip olmalarını sağlar, aynı zamanda kişisel fonlarını kaybetme riskini de azaltır. Mostbet sitesinde oyunları katılabilmek için para yatırma empieza çekme işlemlerinizi eksiksiz yapmanız gerekir. Site yönetimi bu uygulamalar nedeniyle üyelerinden belirli limitlerin üzerinde talepte bulunmalarını bekler. Banka hesap bilgileriniz ile sitedeki profil bilgilerinizin birbirine uygun olması gerekir.

Mostbet’e Kayıt: Adım Adım

Çoğu bahis severin aklını kurcalayan sorulardan biri “Mostbet yasal mı? ” Bu sorunun cevabı, bulunduğunuz ülkenin yasalarına göre değişiklik gösterebilir. Mostbet, Curacao eGaming lisansına sahiptir ve bu lisans, birçok ülkede geçerlidir. Ancak, bazı ülkelerde çevrimiçi bahis oynamak yasaklanmış olabilir. Bu yüzden, yaşadığınız ülkenin çevrimiçi bahis mevzuatını dikkatlice incelemenizi öneririz.

- Spor bahislerinde futbol, basketbol, tenis gibi popüler spor dallarının yanı sıra, e-spor empieza sanal sporlar ag mevcuttur.

- Sahip olduğu Curacao lisans belgesi Türkiye’de geçerliliği olan bir belge değildir.

- Siz de Mostbet üye olarak bu oyunlara kolayca ulaşabilir, gerçek parayla oynayarak kazanç elde edebilirsiniz.

- Engel aldığı zamanlarda adres güncellemelerinin yapılması kaçınılmaz olur.

Ancak, bahis gereklilikleri, oyun kısıtlamaları ve geçerlilik süresi sobre dahil olmak üzere her bonus için şart ve koşulların geçerli olduğunu unutmamak önemlidir. Oyuncuların herhangi bir bonus talep etmeden önce şartları okuyup anlamaları tavsiye edilir. Çevrimiçi bahis yapmak istediğinizde öncelikle para yatırmanız gerekir. Pek çok kişi bu konuda herhangi bir sorun yaşamasa da bazıları sorunlarla karşılaşıyor ve bu konuda ne yapabileceklerini merak ediyor. Mostbet, bahis konusunda en iyi oranları sunan bir çevrimiçi bahis şirketidir.

Türkiye’de Mostbet – Spor Bahisleri Ve Casino

Ayrıca, 7/24 müşteri desteği sunarak kullanıcıların herhangi bir sorun yaşaması durumunda hızlı çözümler sağlar. Online bahis ve casino oyunları dünyası, son yıllarda hızla büyüyen bir sektör haline gelmiştir. Bu alanda sobre popüler platformlardan biri olan Mostbet, kullanıcılara heyecan dolu” “bir deneyim sunmaktadır. Kullanıcılar Mostbet platformu aracılığıyla çeşitli spor etkinliklerine ve oyunlara çevrimiçi bahis oynayabilir.

- Kayıt formunda bonus türünü seçmeniz gerekir – oradan da bonusu reddedebilirsiniz.

- Curacao Oyun Komisyonu tarafından lisanslanmıştır ve kullanıcılarının kişisel ve finansal bilgilerinin güvenliğini sağlamak için en son teknoloji güvenlik önlemlerini kullanır.

- Teklifi almak için kayıt olduktan sonraki yedi gün içinde en az 1, 25 $ yatırmanız gerekir.

- Bu oyunlar gerçekçi grafikler, heyecan verici bonus özellikler ve büyük kazanma şansı ile birlikte gelir.

- Canlı sohbet, e-posta ve telefon gibi çeşitli iletişim kanalları üzerinden destek alabilirsiniz.

- Bir dahaki sefere yorum yaptığımda kullanılmak üzere adımı, e-posta adresimi ve net site adresimi bu tarayıcıya kaydet.

Sonrasında kaybınızın bir kısmını bu şekilde geri alabilirsiniz. Adreslerin güncellenmesi ile birlikte ortaya güncel adres sorunsalı çıkar. Sürekli olarak siteye giren kişiler için bu problem olmasa da belirli aralıklarla giriş yapanlar sitenin güncel adreslerini merak eder. Mostbet sitesi üyelerinin en iyi kalite standartlarında oyun hizmeti almasına olanak tanır.

Mostbet’teki Oyuncular Için Bonuslar

Kripto para birimleri, hızlı işlem süreleri ve anonimlik avantajı sunar. Çevrimiçi bahis ve online casino hizmetleri sunan popüler bir platformdur. Bu makalede, Mostbet‘e nasıl kayıt olabileceğinizi adım adım açıklayacağım. Mostbet tarafından sunulan kredi/banka kartları, e-cüzdanlar, banka havaleleri ve diğerleri gibi para çekme seçeneklerinden birini kullanmak suretiyle kazancınızı nakde çevirebilirsiniz.

- Kısa ve öz cümleler kullanarak, kullanıcıların hızla istedikleri bilgilere ulaşmalarını sağlar.

- Mostbet Giriş türkiye, dünyadaki spor hayranları ve oyuncular arasında popülerlik kazanmayı başarmış yeni bir sitedir.

- Mostbet uygulamasını mobil cihazınıza indirmek için sah web sitesine girerek uygulama indirme linkini takip edebilirsiniz.

- Her türlü kolaylığı sizlere sunan bahis empieza casino sitesi özellikle iyi standartlarda hizmet almanızı sağlar.

- Sizler para Mostbet bahis sitesinde üyelik oluşturarak bu güvenli ödeme yöntemleriyle para yatırma ve çekme işlemleri gerçekleştirebilirsiniz.

Örneğin, bir oyuncunun Mostbet yalnızca bir hesabı olmalıdır, kullanıcı 16 yaşından büyük olmalıdır. Bilgileriniz doğrulanmadan em virtude de yatıramaz, bahis oynayamaz, casino oynayamaz veya para çekemezsiniz. Türkçe dili mevcuttur, sayfaların Türkçeye çevirisi doğru ve nettir. Yükleme düğmesi (aynı zamanda mevcut bakiyeyi para gösterir), çeşitli ödeme sistemleri içeren yükleme penceresini açar. Bunlardan herhangi birini seçerseniz, yatırmak istediğiniz tutarı seçebileceğiniz bir ekran göreceksiniz. Evet, Mostbet’te bir maç veya oyun devam ederken canlı bahis oynayabilirsiniz.

Mostbet’te Canlı Bahis Seçeneği

Mostbet, çok çeşitli spor dallarına, liglere ve turnuvalara bahis oynayabileceğiniz en iyi çevrimiçi bahis şirketlerinden biridir. Sitede sprained ankle treatment popüler hem” “de niş sporlardan oluşan harika bir seçim var, bu weil bahis yapmak için favori sporu bulmayı kolaylaştırıyor. Ancak, Mostbet’te kullanıcıyı tanımlamanın yanı sıra, doğrulama yapılır – oyuncunun kimliğini ve adres verilerini doğrulayan bir dizi belge kontrol edilir. Genellikle doğrulama, daha önce yapılan mevduatlardan birkaç kat daha büyük bir miktarın ödenmesi istendiğinde yapılır.

Bu uygulamaların tercih edilmesinin en önemli nedeni internet bağlantısı olan her yerden siteye erişim sağlayabilmektir. Bilgisayara olan bağlılığı en aza indirdiği için oldukça önemli hizmetlerden biridir. Telefon ve tablet gibi akıllı cihazları yüklenecek uygulama sayesinde platformda daha eğlenceli vakit geçirmek mümkündür. Mostbet mobil uygulama ayrıcalıklarından yararlanmak için kesin olarak güncel uygulamaları indirmeniz gerekir. Üyelik işlemleri sırasında bilgilerinizin doğru ve eksiksiz olması gerekir.

Mostbet Çevrimiçi Spor Bahisleri

Para çekme yöntemleri kullanıcıların tercihlerine göre değişebilir empieza ülkelere göre farklılık gösterebilir. Bu nedenle, Mostbet’in resmi internet sitesini ziyaret ederek mevcut para çekme seçeneklerini kontrol etmeniz önemlidir. Mobil uygulamaların önündeki en önemli avantajlardan biri Mostbet mobile version – bahisçi ofisinin hizmetlerine erişim hızı. Mostbet, bilgisayar, laptop, tablet gibi cihazlarda mükemmel bir şekilde çalışan ve kaliteli hizmet sunan bir gambling establishment websitesidir.

- Ödeme sistemlerinin çoğu için aynı ekranda bir COMMONLY ASKED QUESTIONS düğmesi vardır, bu düğmeye tıklayarak bu para yatırma yöntemi hakkında bilgi okuyabilirsiniz.

- Hoş geldin bonusları, para yatırma bonusları, ücretsiz spinler gibi çeşitli promosyonlarla kullanıcılarına daha fazla kazanma şansı verir.

- Mostbet’te Powerball ve Super Millions gibi çeşitli piyango oyunları arasından seçim yapabilirsiniz.

- Hoş geldin bonusu, yatırım bonusları, kayıp iadesi ve diğer özel promosyonlar, kullanıcıların daha fazla kazanmasına ve oyunları daha uzun süre deneyimlemesine olanak tanır.

- Bunlar arasında yatırım bonusları, kayıp iadesi, bedava bahisler, ücretsiz dönüşler empieza özel etkinliklere katılım fırsatları yer almaktadır.

- Bununla birlikte, Türk kullanıcılar için Mostbet’in işlevselliği azaltılmış bir sürümü vardır (kumarhane kumar, poker, slot yok).

Mostbet sitesine erişiminiz yoksa, Mostbet sitesine erişmek için VPN hizmetini veya ikiz site alternatif joe adını kullanabilirsiniz. Mostbet bahisçi ofisi empieza kumarhanesi için benefit kazanma koşulları aynıdır, ancak sadece bahis oynama koşulları farklıdır. Mostbet’in mobil uygulamadaki kayıt formunda, sitedeki benzer formdan sadece bir fark vardır – gelişmiş kayıt seçeneği yoktur. Böylece, her türlü bahis ve oyun tutkununa hitap eden bu platform, sürekli gelişen içeriği ile üyelerine heyecan verici bir bahis ortamı sunmayı başarmaktadır.

Para Yatırma Seçenekleri

Mostbet bahis şirketi, yeni üyelere hoş geldin bonusu, kayıp bonusu, yatırım bonusu gibi çeşitli bonuslar sunmaktadır. Kullanıcılar çevrimiçi bahis yaparken güvenli bir deneyim yaşarlar. Yardım Masası Sohbeti İngilizce, Fransızca, Rusça, İspanyolca, Almanca, İtalyanca ve Hindu dillerinde kullanılabilirken, web sitesi dilleri 25’i aşmaktadır. Hesabınıza VISA, Mastercard ve çeşitli yerel ödeme sistemleri aracılığıyla para yatırabilirsiniz.

- Evet, Mostbet canlı casino oyunlarında gerçek krupiyelerle oynama fırsatı sunar, böylece gerçek bir online casino deneyimi yaşamanızı sağlar.

- Mostbet kaydı, çevrimiçi spor bahisleri organizasyonunda bir hesap açma sürecidir.

- Hoş geldin bonusu genellikle kullanıcıların ilk yatırım miktarına bağlı olarak değişir ve hesaplarında ekstra bir miktarla bahis yapmalarını sağlar.

- Kazancınızı çekmek için kullanacağınız adresin empieza çekim yöntemlerinin size ait olması oldukça önemlidir.

Uygulama Rusça empieza İngilizce olarak mevcuttur, böylece size durante uygun dili seçebilirsiniz. Ayrıca spor bahisleri, casino oyunları empieza daha fazlası için de kullanabilirsiniz. Papara yatırım bonusu ag sitenin en önemli bonusları arasında yer alır. Bu bonusu alabilmek için sisteme 50 TL’den fazla yatırım yapmak gerekir. Mevcut promosyondan tekrar yararlanabilmek için olan bonusu kapatması veya tamamlaması gerekir. Mostbet sitesinde” “özellikle uygulamalar üyeler tarafından çok tercih edilir.

Mostbet Kişisel Hesabınıza Giriş Yapma Talimatları

Uygulama, Android empieza iOS işletim sistemlerine sahip cihazlarla uyumludur ve kullanıcılar bu platformlarda rahatlıkla erişim sağlayabilirler. Kolay navigasyonu ve sezgisel tasarımı sayesinde, yeni başlayanlar bile hızla siteyi keşfedebilir ve istedikleri oyunları bulabilir. Ayrıca, mobil uyumluluğu neticesinde istediğiniz zaman empieza yerde oyun deneyiminin keyfini çıkarabilirsiniz. Bu çevrimiçi kumarhane platformu, kullanıcıları için güvenli ve adil bir oyun ortamı sağlamak için gerekli önlemleri almaktadır.

- Para çekme işlemi tamamlandıktan sonra, süreç tamamen ödeme yönteminize ve bankanıza bağlı olarak değişiklik gösterebilir.

- Com web sitemiz, 2009’dan başlayarak on yıldan fazla bir süredir spor bahisleri hizmetlerini sunmaktadır.

- Geniş oyun seçenekleri, mobil uyumluluk, güvenilirlik ve kullanıcı dostu yaklaşımı sayesinde kullanıcılarına heyecan dolu bir deneyim sunmaktadır.

Bu added bonus, kayıt işlemi tamamlandıktan sonra hesabınıza yapılan ilk para yatırma işleminden elde edilen” “bir bonus tutarıdır. Hoş geldin bonusu genellikle kullanıcıların ilk yatırım miktarına bağlı olarak değişir ve hesaplarında ekstra bir miktarla bahis yapmalarını sağlar. Mostbet’e para yatırmak ve çekmek için öncelikle çevrimiçi spor bahisleri kuruluşunda bir hesap oluşturmanız gerekir. Para yatırma empieza çekme için kesin prosedür, kullandığınız platforma veya cihaza ve mevcut ödeme seçeneklerine göre farklılık gösterebilir.

Mostbet Bahis Şirketinin Faydaları

Ana hoş geldin bonusunun yanı sıra, bahis şirketinin düzenli Mostbet bonusları weil bulunmaktadır ve tüm bölümleri etkiler. Yüksek profilli spor etkinliklerine ve siber sporlara bahis yapma, belirli casino oyunlarında iyileştirilmiş koşullar gibi seçenekler sunar. Promosyonlara erişim için üst menüde bulunan “Promosyonlar” düğmesine tıklayabilirsiniz.

Ayrıca kripto para birimi işlemlerini desteklediği için anonim olarak bahis oynamak isteyen oyuncular için tasarlanmıştır. Mostbet bahis platformu, kullanıcılarına cazip bonuslar ve promosyon kodları sunarak onların oyun deneyimini zenginleştirmeyi hedeflemektedir. İster spor bahisleri alanında isterse de online casino oyunlarında farklı promosyon seçeneklerinden faydalanmak mümkündür.” “[newline]Örneğin, yeni üyeler için hoş geldin bonusu, mevcut kullanıcılara ise yatırım ve kayıp bonusları gibi çeşitli kampanyalar düzenlenmektedir. Mostbet, Türkiye’de spor bahislerinden canlı kumarhane oyunlarına kadar geniş bir yelpazedeki kumar ve bahis seçeneklerini arayan kullanıcılar için excellent bir tercihtir. Mostbet bahis şirketi, kullanıcılarına yüksek oranlar empieza bir dizi eğlenceli oyun sunarak, bahis piyasasında kendine sağlam bir yer edinmiştir.